Most recent News & Articles

Innovation Masters: Banks at the forefront of women's business empowerment

A selection of innovative projects empowering female entrepreneurship, submitted for the Qorus Banking Innovation Awards in recent years by KCB, NBK, Maybank, Bradesco, Banco Pichincha and UniCredit.

MetLife Pet Insurance partners with the Association of Animal Welfare Advancement

MetLife Pet Insurance and the Association of Animal Welfare Advancement (AAWA) have joined forces to address pet owners' challenges in...

Lemonade expands homeowners insurance offering in France

Lemonade, the digital insurance company, has expanded its offerings in France by introducing Homeowners insurance in partnership with BNP Paribas...

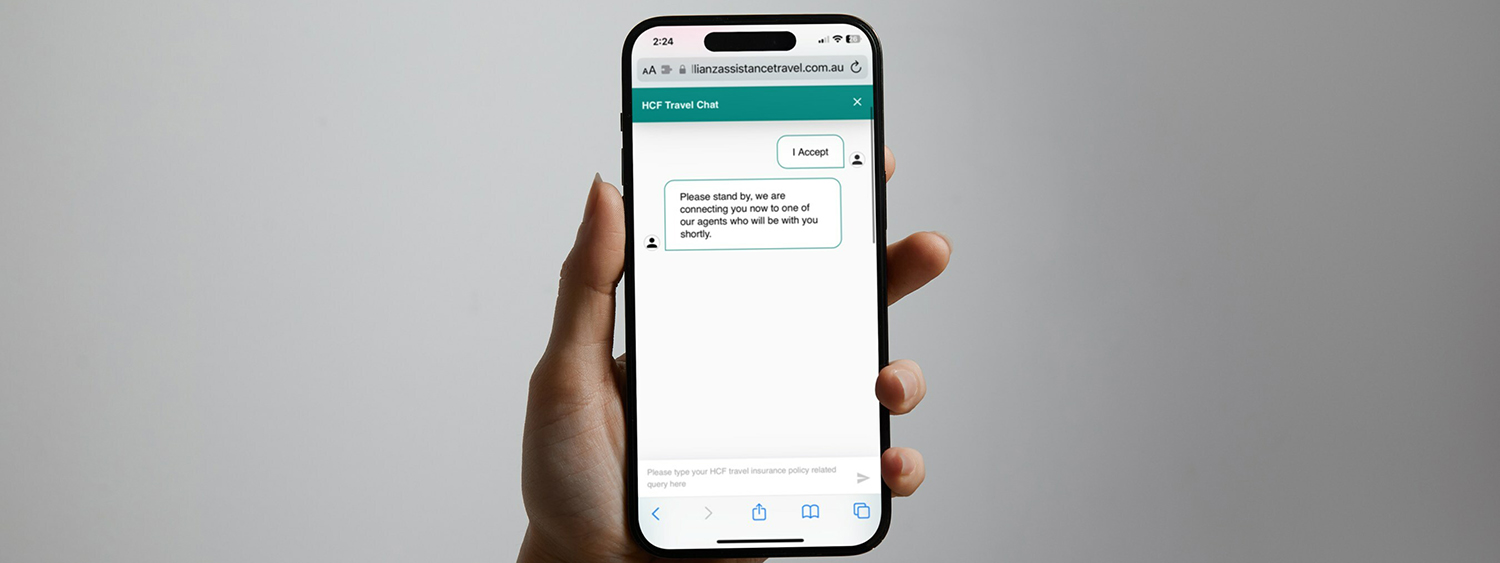

Allianz Partners introduces instant online chat for HCF travel insurance customers

This pioneering service furnishes HCF members with real-time support for their travel queries, broadening the avenues through which customers can...

ANZ NZ pumps $4 million into AgriZeroNZ for farm emissions reduction

ANZ Bank New Zealand is doubling down on its environmental commitment with a $4 million investment in AgriZeroNZ, a partnership...

NAB app streamlines online shopping with PayPal integration

This pioneering feature, a first in Australia, enables NAB users to effortlessly add and manage their preferred payment cards directly...

UK property market leaders collaborate to revolutionize home buying

Lloyds Banking Group, Nationwide, NatWest, and Rightmove have united in a strategic investment in Coadjute, a London-based property technology firm....

Most recent Studies & Reports

Driving forces: The interplay of financial services and the EV sector

The financial services sector and the electric vehicle (EV) sector are two dynamic realms undergoing a significant transformation in today's...

A bancassurance breakthrough: Nurturing SME relationships through customized insurance products

In this paper, we outline the opportunity bancassurance presents to banks, as well as the key considerations that should be...

Innovation Radar: Reinvention Awards Europe winners 2024

Discover the most innovative projects from banks and insurance companies in Europe.

Unleashing SME banking potential with embedded finance: Simplifying financial services to create unprecedented convenience for SMEs

In this paper, we will unravel the key challenges that banks need to address to not only navigate the upcoming...

Latest innovations

CARA: Transforming Irish Life's Claims Experience through Leading-Edge AI Innovation

Background At Irish Life, we are honoured to support the physical, mental, and financial wellbeing of our 1.6 million customers...

Mi Seguro Chevrolet

Chevrolet Auto insurance (Seguro Chevrolet) is a value-added product of GM Financial Chile, distributed through Chevrolet dealerships. We have tackled...

MOVERTI

Given the emergence of new forms of mobility in cities, such as carsharing, or personal mobility vehicles (MVP), Verti wants...

Digital Rehab

It is not new that the COVID-19 pandemic was a driving factor for change and transformation in the health field....

Join the Qorus

Today, Qorus is a catalyst for reinvention for our financial services members by helping them to go further, be faster and work together.

Forthcoming events

Integrating biodiversity and nature risks into climate risks in financial institutions

In today's changing environmental landscape, integrating biodiversity and nature risks into climate risks is pivotal for financial institutions. Understand the interconnected challenges and explore best practices in navigating this complex terrain.

Cybersecurity: The role of the banks and insurance

Examine symbiotic relationships between financial institutions and embedded cybersecurity insurance, emphasizing collaborative efforts against digital risks and cyber threats.

Reinvent Forum Lisbon

Reinvent Forum Lisbon - is dedicated to the digital transformation influencing the insurance sector. Our event brings together industry leaders, experts, and innovators to delve into the latest trends and strategies for enhancing customer satisfaction through innovative digital endeavors. Attendees can expect profound insights into the evolving landscape of insurance.

Electric vehicle charging

Future position of insurance in mobility will be shaped by ongoing technological advancements, changing consumer behavior, and evolving regulatory frameworks. One of the key roles of insurance in mobility will be to provide coverage for new and emerging risks associated with the use of new technologies, such as autonomous vehicles...

Climate change and insurance gap

Climate change intensifies the insurance gap, driving a surge in extreme weather events and economic losses. Join our online event to collaborate on building a more resilient future in the face of climate change.

We help banks and insurers to reinvent themselves to thrive.

Further

Further

We curate inspiring and innovative projects, technology and ideas so individuals, teams and organisations can collectively create the future of financial services.

Faster

Faster

We’re a catalyst for reinvention, improving revenue generation, creating efficiencies, redefining customer experiences and forming profitable relationships.

Together

Together

We're a neutral space where members unite to share, learn and collaborate, thinking freely to solve problems through an ecosystem of unique, specialist communities.